Uber Eats ventures into nationwide shipping... two years after the pandemic's start

Instead of playing catch-up, maybe they ought to skip ahead a few chapters

Had it happened in 2020 (or even as late as 2H2021), we might’ve seen a lot more fanfare for Uber Eat’s announced nationwide shipping program. But instead, fast forward two years into the pandemic for the company’s foray, which ends up feeling more like a head scratcher than anything what with its timing coinciding with continued supply chain woes.

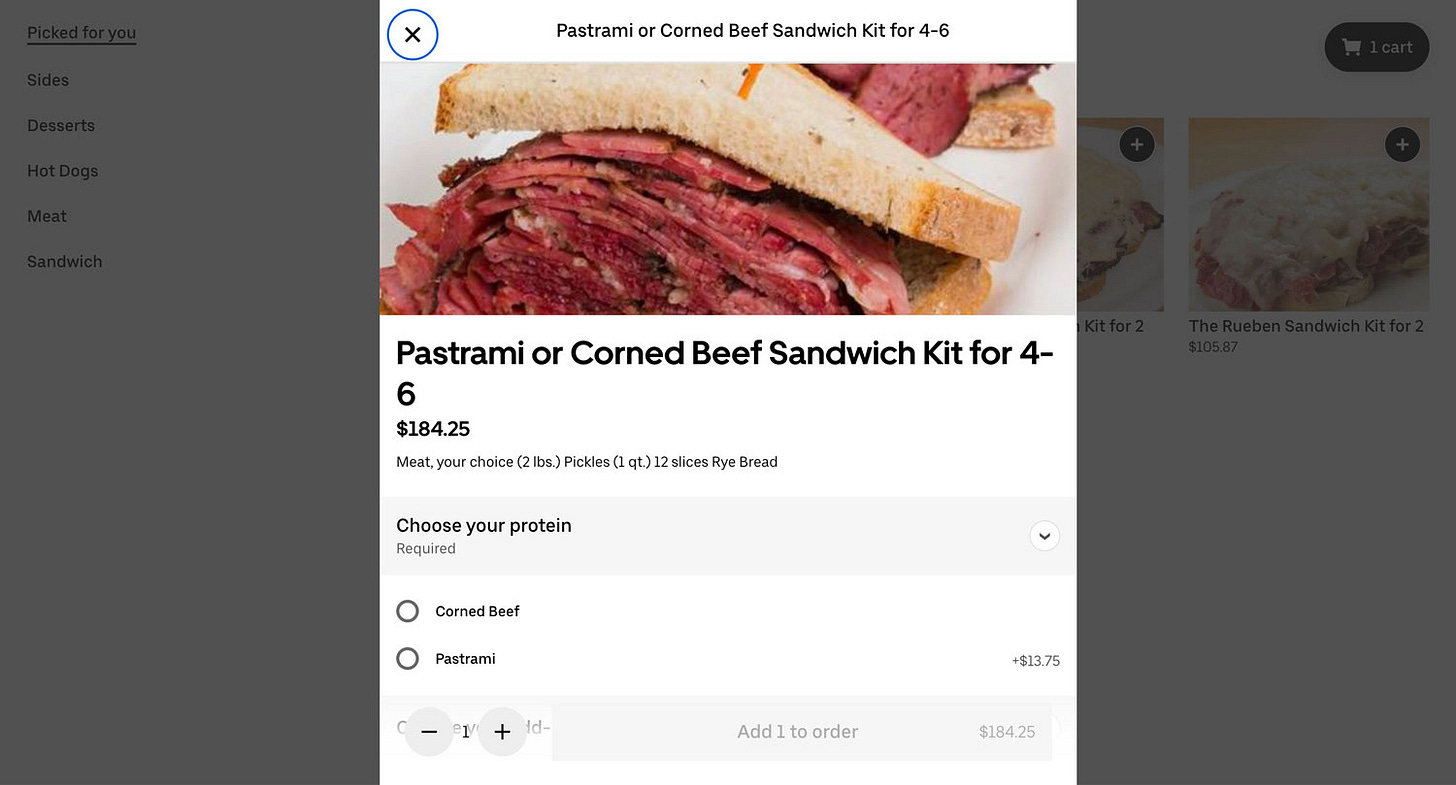

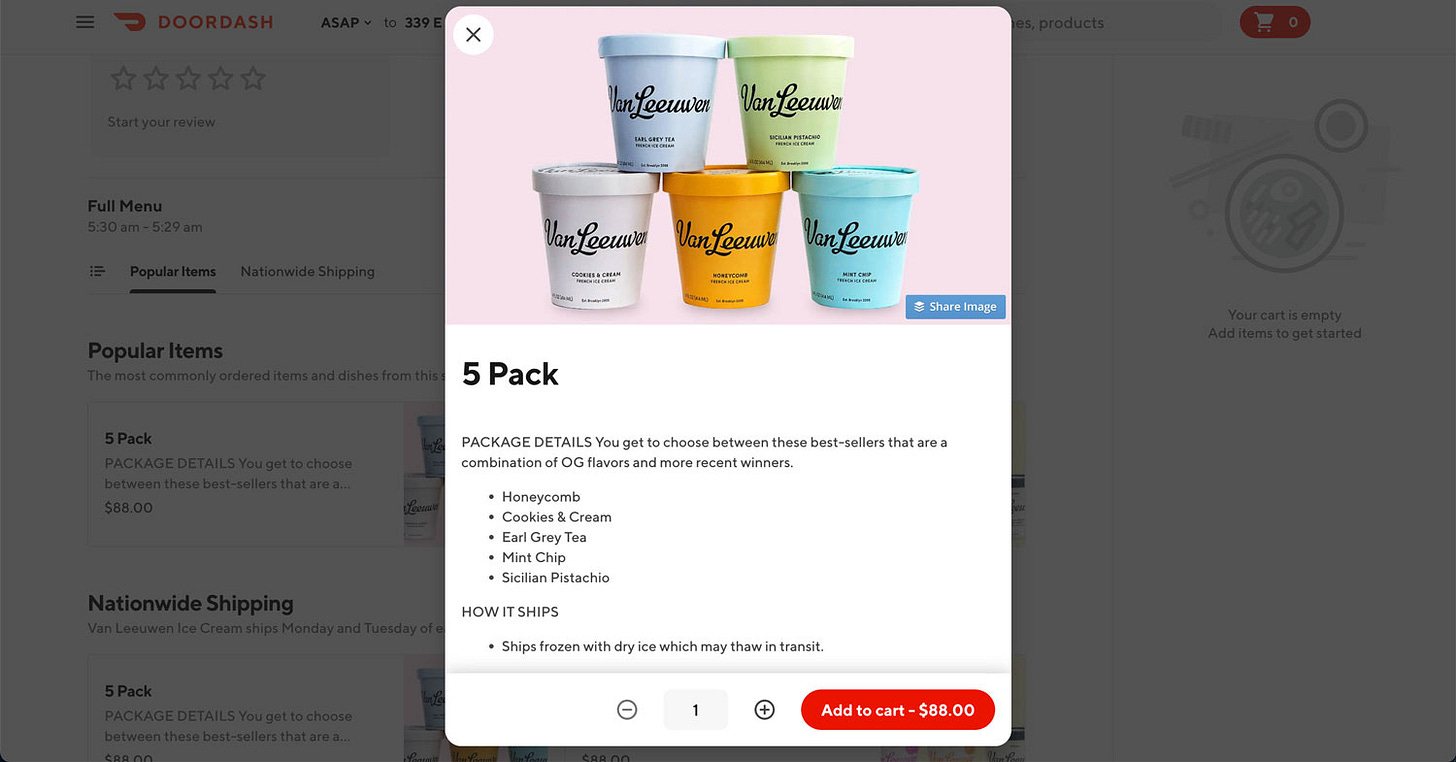

Launching with restaurants in three markets—New York, Los Angeles, and Miami—customers can order natively from the Uber Eats platform. Orders are fulfilled by the restaurant, and subsequently tendered to FedEx to handle the last leg of the trip over the course of five to seven business days. The logistics are far from novel: DoorDash and Goldbelly operate similarly, serving as platforms that provide both a potential audience and a place to facilitate transactions.

However, in shipping with DoorDash and Goldbelly, frozen goods—such as ice cream or frozen dumplings—are offered for delivery, all the while staying mindful of dry ice’s sublimation rate. However, it looks like Uber is playing it safe in only opting in for items that do not require staying frozen upon arrival.

I suppose my curiosity isn’t so much about why Uber is bothering to extend into this line of business, but rather, if they are to get into the shipping game this late, why not at least have the infrastructure in place to actually scale and compete?

Uber’s slow start, marred by first-to-market competitors

Even by their own admission, Uber knows that they are late to the game. Take the quote below, which acknowledges that 2020 and 2021 marked the accelerated demand and growth for delivery of perishable food products.

Over the last few years (especially during two years of lockdowns with decreased travel), consumers have shared their desire to bring specialty food items straight to their home.

But this isn’t just something consumers have asked for. We’ve heard loud and clear merchants’ desire to diversify their offerings and reach new consumers.

By not being first (or even second) to market, Uber has lost out considerably on its debut roster. It wouldn’t surprise me if a lot of the restaurants shipping nationwide have already been swept up under exclusivity contracts by DoorDash and Goldbelly. Such agreements make sense as a protective measure to ward off brand dilution, maintaining cachet for the eCommerce sites. After all, what value do these platforms possess if the frequently touted eateries can be so readily found elsewhere?

The space of transforming restaurants into potential CPG experiences is still a rather nascent one, and for good reason. Shipping logistics are a harder nut to crack than the framework on which local delivery operates. Think about it: shipping encompasses a whole slew of partners and vendors; whereas local delivery relies on a far smaller ecosystem comprised of gig economy workers and apps. It makes sense to not only protect the platform from losing its unique selling proposition of being able to deliver high-value brands, but also to protect the sizable investments made in knowledge and operations for as long as possible. For better or worse, the ante is thereby upped with each new platform trying their hand at it, all the while having a dwindling pool of brands until a tipping point is reached.

Where Uber could’ve boldly gone

Sure, I could go on about how I would’ve liked to see Uber Eats glean from DoorDash and Goldbelly’s merchant pages and find a way to better fold in shipping information, and storage and cooking instructions.

But I much prefer to have seen a vastly different approach that would provide an opportunity to establish a real unique selling proposition to meet their “merchants’ desire to diversify their offerings and reach new consumers.”

Let me just spitball here.

Instead of placing the burden (and subsequent YMMV experience) on restaurants to produce, pack, and ship, why not remove that impediment and invest in something that would be alluring: a third-party logistics (3PL) service that lets the restaurant do what they do best—provide the food—and let everything else be handled by Uber. In other words, divert the resources spent on this losing an arms race into something that could be considered the next phase of restaurants engaging in CPG.

Granted, there are hurdles to cross what with being able to operate as a 3PL provider, such as buildout, SQF (Safe Quality Food) certification, and food safety processes and personnel to name a few (from my admittedly limited knowledge here).

And on the Uber-meets-merchant side of things, key obstacles include getting restaurants to decide upon offerings that make sense to scale and distribute, and execute said products in a way that meets food safety regulations. What this partnership may very well entail is a far more selective onboarding, resulting in closely handholding chosen restaurants through finding and vetting co-packers. Or an even further interesting move would be the investment of direct dollars into building out or buying costly—albeit compliant—facilities that can not only solve for production, but also generate revenue for Uber as said co-packing partners.

Whatever route Uber is headed down is going to be an expensive one that may very well never yield any profits. While they might as well make a go of it in a sector that they’ve admittedly spent the last two years observing, they should perhaps go after it in a way that looks forward—where restaurants want to head (but haven’t due to a lack of readily available resources)—instead of chasing where they’ve already gone.

Elsewhere

Somehow we let me have a platform beyond your inbox?

Anywho, here are two quick clips from the last few weeks.

QuickBooks: “Small business tour: Nom Wah”

Expedite: “I spent several hundred dollars on food-themed NFTs and here’s what I learned”

Further reading

Eater: “The doughnut kids are all right”

The Globe and Mail: “Fake meat was touted as the ‘future of food.’ Why did it fail to deliver?”

Toronto Star: “Meet the people behind the rise of ‘80s and ‘90s Hong Kong culture in the GTA”